pa educational improvement tax credit election form

Use the REV-1123 Educational ImprovementOpportunity. How do I properly complete the OSTC Appendix XV Annual Report.

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

In return they received a total of 124 million in Pennsylvania tax credits.

. Pennsylvania makes millions of dollars available each year through the Educational Improvement Tax Credit Program EITC to. MY PA STATE TAX IS 12000 AND I AM AT 32 FEDERAL TAX RATE. Enter the amount of the EITC awarded and the tax year of.

HARRISBURG PA 17128-0701 EDUCATIONAL IMPROVEMENT TAX CREDIT ELECTION FORM See Page 3 for instructions. Tax questions may be directed to the Department of Revenue. Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through to shareholders members or partners.

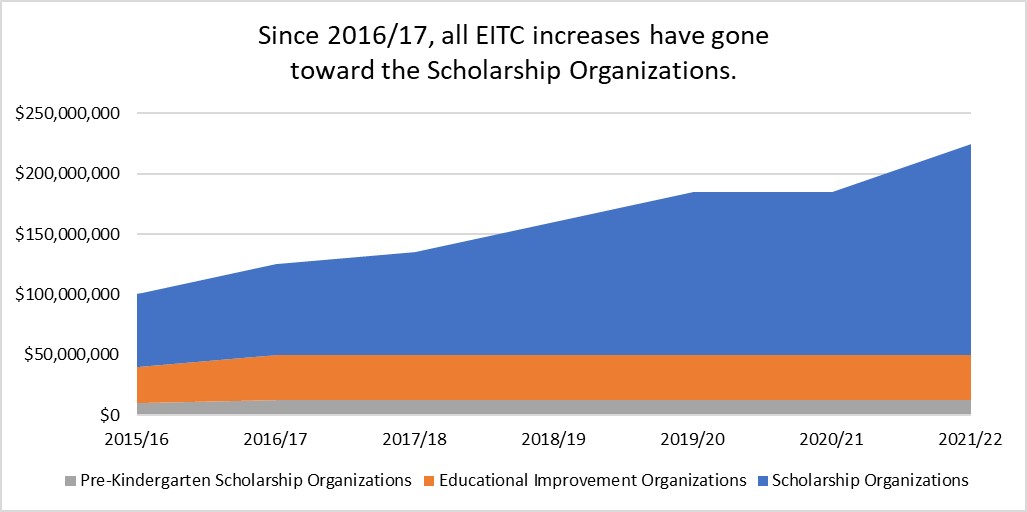

Number FEIN SSN YYYY 1a. Irrevocable election to pass Educational Improvement Tax Credit. The program budget was capped at 135 million that year The program is most popular in.

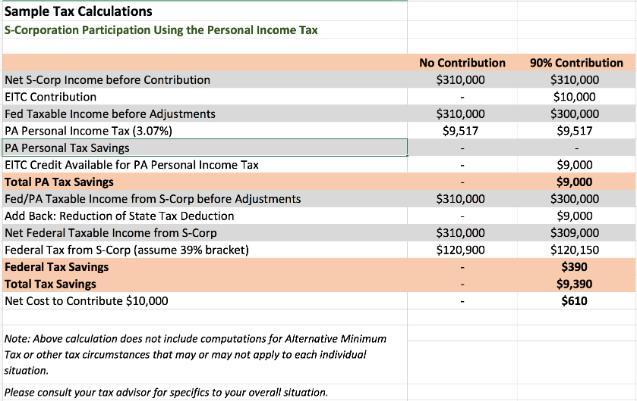

PA tax savings 13333 gift x 90. Foundation listed as SPARKS Foundation on the list of approved organizations is approved as an Educational Improvement Organization EIO as defined by. Additionally the REV-1123 Educational Improvement Opportunity Scholarship Tax Credit Election Form will be revised to reflect the carryover provisions.

Donation to CSFP through CSFP LLC. PA DEPArTMENT OF rEVENuE BurEAu OF COrPOrATION TAxES - EITCOSTC uNIT PO BOx 280701. A complete form OC is.

Election to apply unused EITCOSTC to the tax liability of the owners in the taxable year immediately follow-ing the year in which the contribution is made. Taxpayers must complete the REV-1123CT Irrevocable Election to Pass Through Educational Improvement Tax Credit to Shareholders members or partners owners form. List of Educational Improvement Organizations Effective 712015 6302016 EITC.

Applicants can contact the Tax Credit Division at 7177877120 to be connected to their assigned project analyst. Scholarship Tax Credit Election Form to report the amount. Fillable Rev 1123 2020-2022 Form.

Return the election form to. Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1123 Pass-Through Entity Name. REV-1123 -- Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1190 -- Tax Worksheet for PA-20SPA-65 Schedule M Part B Section E Line a REV-1849 --.

For the 2021-22 school year the maximum scholarship award available to non-special education students is 8500 and the maximum for a special education student is 15000. Individual donors must file a Pa 40 individual or joint tax return for the year and include the 90 payment tax credit on page 2 line 23 other credits. A separate election must be submitted for each year an EITCOSTC is awarded.

A program that benefits. EDUCATIONAL IMPROVEMENT PO BOX 280604. Latest Pennsylvania News Wolf Administration Announces 25 Million in Funding for Western PA Start-Up Tech Companies April 28 2022 Gov.

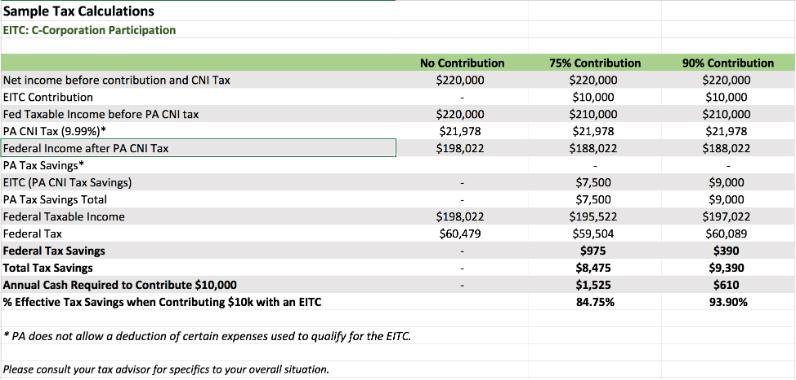

The Pennsylvania Educational Improvement Tax Credit EITC can be very beneficial to companies conducting business in Pennsylvania by reducing tax liability. Department Use Only Address. Country View Family Farms.

A pass-through EITCOSTC can be applied to all classesof income earned by the owners. Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax. Pennsylvanias Educational Improvement Tax Credit program helps tens of thousands of students access schools that are the right fit for them but policymakers could do more to.

To pass through an Educational Improvement or Opportunity Scholarship Tax Credit complete and submit form REV-1123 Educational ImprovementOpportunity Scholarship Tax Credit. Of Educational Improvement Tax Credit EITC or Opportunity. Businesses individuals and schools.

Get and Sign Fillable Rev 1123 2020-2022 Form.

School Resources Provident Charter School For Children With Dyslexia

Tax Legislation Update Updated Framework For Build Back Better

Fill Free Fillable Forms For The State Of Pennsylvania

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

Educational Improvement Tax Credit Eitc Program Bucks County Community College

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

Educational Improvement Tax Credit Eitc Program Bucks County Community College

How To File Taxes For Free In 2022 Money

New York Education Laws Lexisnexis Store

Educational Improvement Tax Credit Eitc Program Bucks County Community College

Tompkins Vist Bank Contributes To Youth Education Organizations Daily Local

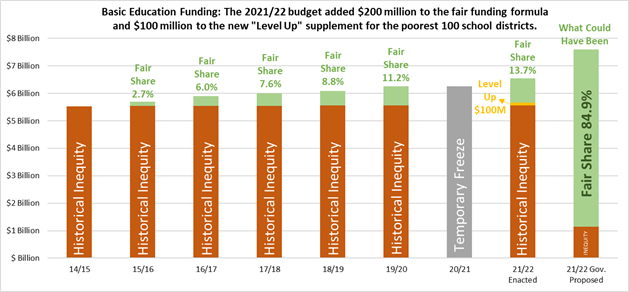

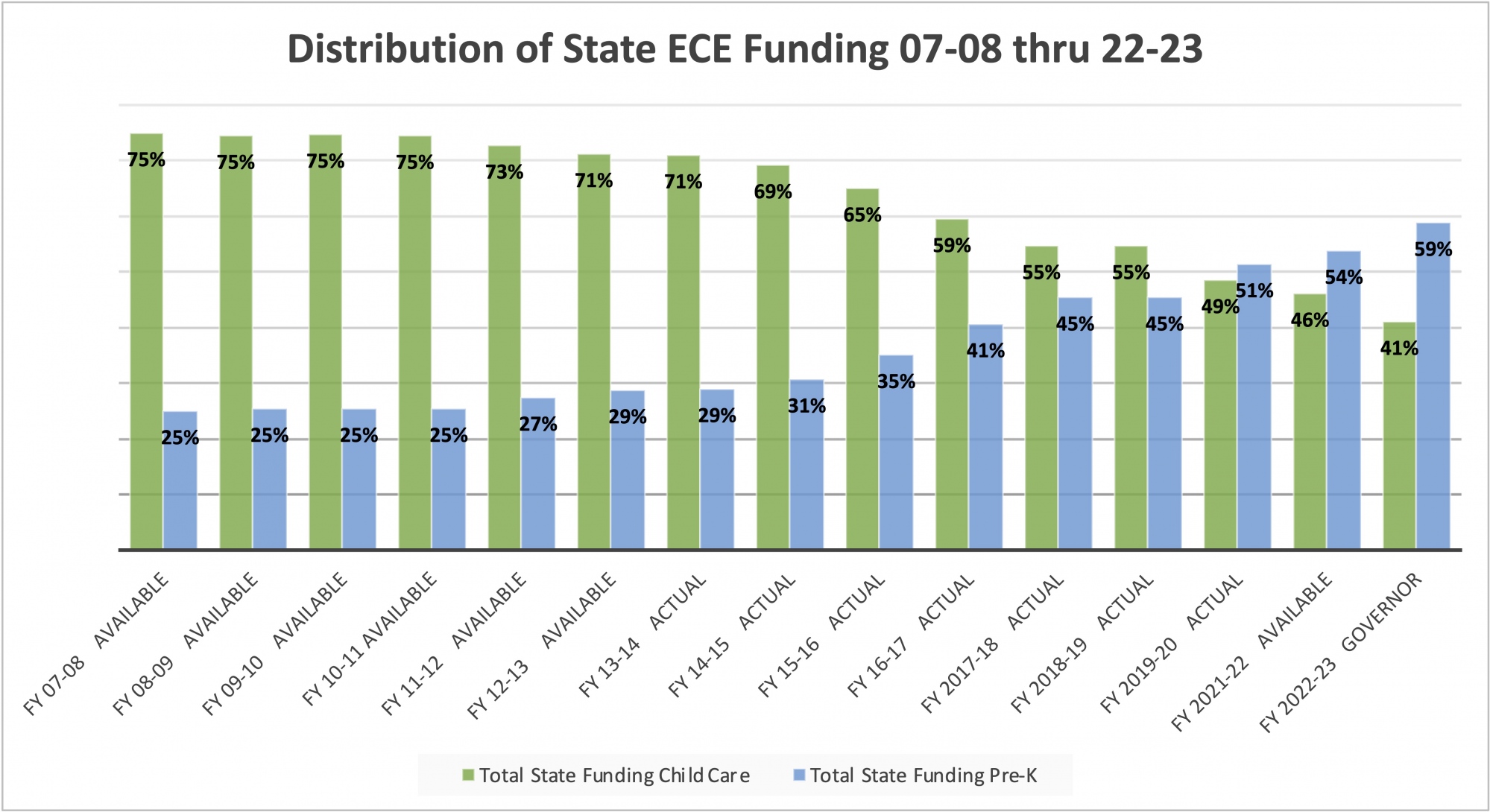

State Policy Budget Issues Pennsylvania Child Care Association

Pa Tax Update 2021 R D Credit Award Letters Delayed Until May 1 2022

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation